The latest forward curve shows Diesel being steadily backwardated in the prompt with demand strong and supply having been disrupted by Hurricanes and upcoming refinery turnarounds in Europe. This backwardation has meant that volumes in storage have been drastically reduced over the last couple of months as holders of inventory would take a hit on the roll. With current backwardation, there is little incentive to refill tanks and inventory levels will be kept low putting a damper on demand. Refinery maintenance during autumn, the onset of winter forcing greater demand for heating and the list of refineries undergoing maintenance work becoming larger have all been supportive for Diesel. Sentiment in Diesel is still bullish but spreads appeared to have stabilized somewhat. CIF Med 10ppm has been printing at low premiums to ICE Gasoil due to the steep backwardation of ICE Gas Oil futures.

Arb cargos from the east ending in the Mediterranean are looking for a place to call home as specs are more suitable but are still struggling due to a lack of demand for physical as stocks are run down. However, this has been supported with less barrels moving over from the Gulf Coast due to the supply interruptions last month. Expectations are for this to pick up with US refineries returning to normal and approaching high utilization rates once more as long as those barrels are not directed towards Central and South America. East West arb has been open on paper but 10ppm has been difficult for many players to source in the East reducing the amount of physical moving across. Curve shows a more balanced market for summer 2018 with shallow backwardation with the market in contango from Summer 2019.

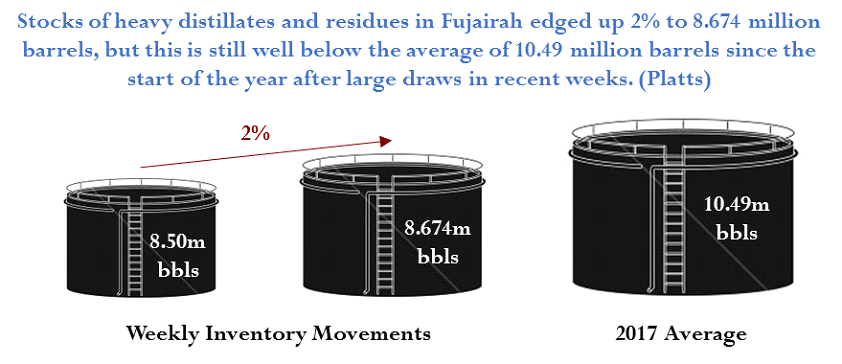

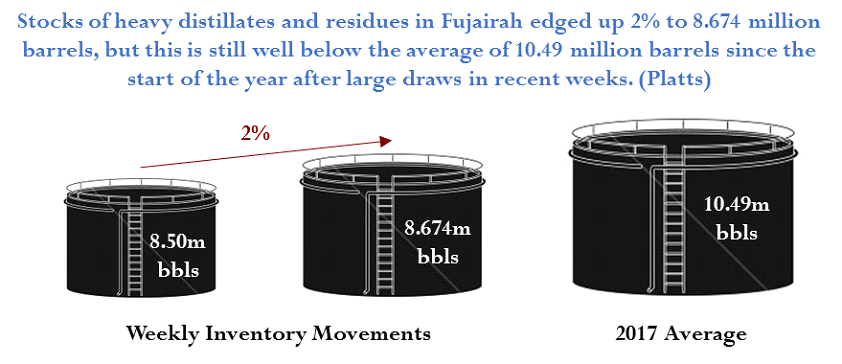

Fuel Oil remains in steady backwardation of c.$1/mt to $1.5/mt average over the next year or so. Demand has remained healthy for both bunker and utility grades and market is predicted to tighten as less exports of Residual Oils are seen from major exporters such as Russia, Iran and Venezuela. This is mainly caused by an increased number of upgraded refineries now which is driving a greater amount of Fuel Oil being cracked for more favorable products such as Diesel. Fuel Oil cracks have remained very high on a percentage basis and have picked up dramatically since the middle of 2016. Currently Singapore physical market has weakened slightly, with relatively high stock levels leading to lower premiums as market participants sell to create ullage. This is expected to tighten over the next month or so with a closed West to East arb leading to less volumes arriving and those that do will be at a higher cost. Arab Gulf premiums have increased over the last week or so as demand has remained steady and less exports

have been seen out of Iran, as domestic use has forced a higher utilization for their Residual Fuel Oil.

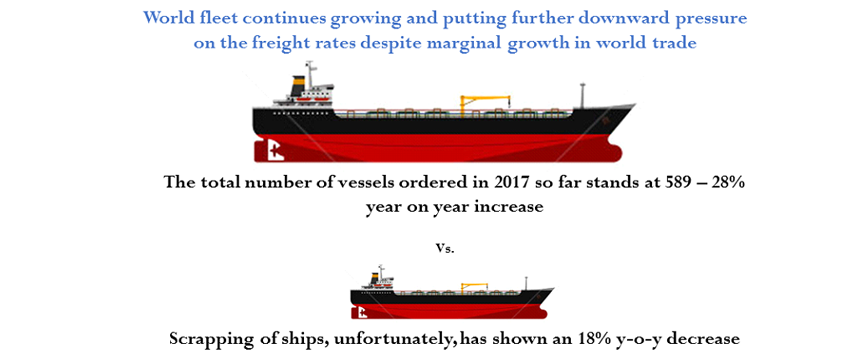

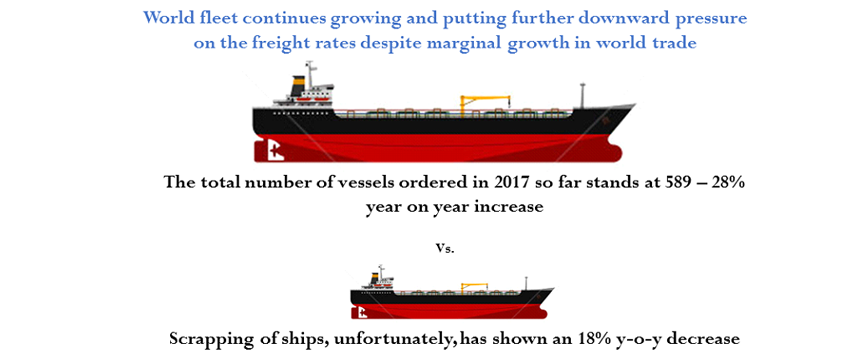

The overall supply driven recession in shipping, which started in 2008 after the financial crisis has been ongoing for nearly 10 years now, with recovery nowhere in sight. Except for some minor spikes in the dry bulk freight rates at present, the industry continues to suffer from having too many ships on the water, supply far exceeding demand. As for the regional shipping market, here in the Gulf region, the story is no different from the macro picture shown above. The increasing geopolitical tensions in the region have both negatively impacted but also opened up interesting opportunities for the regional shipping industry.

The Iran sanctions, although officially lifted nearly 2 years ago, a great deal of uncertainty remains over them. Potential trade with Iran is often held up due to wariness among international banks to provide finance. The Qatar blockade has had a negative impact overall on shipping, and no one really knows how long the diplomatic stand-off will continue. It has opened up some opportunities for Oman who has, for the time being, replaced UAE as the main supplier of aggregates (building materials) to Qatar. Growth in maritime related infrastructure in the GCC region continues expanding at a rapid rate, with a high level of ambition and optimism shown in these projects.

Ennero Group is an oil commodity trading house and logistics specialist. Our belief is that the global economy requires energy solutions developed and built for the future. Performance and innovation being our guiding principles, Ennero applies non-traditional means to add value for regional and industrial energy supply challenges. Ennero primarily focuses on the trading and physical distribution of petroleum products of various specifications such as Gasoil, Gasoline, Fuel Oil, Crude Oil, LPG and Lubricants.

Director – Trading & Derivatives

London, UK

Phil leads and supports mandates globally with a specialized focus on Africa and the Med. Phil has worked in the oil trading industry in key roles for 9 years with industry leaders such as Trafigura focusing on trading strategy and price risk management. Prior to that he was within the banking sector with both JP Morgan and Bear Stearns. For inquiries:pl@ennero.com – +44 7486 973355

Trading Manager

Dubai, UAE

A seasoned shipping professional, Apurva has studied and worked in the shipping and oil industry for over 14 years in the major shipping hubs of Singapore, London and Dubai. Currently based in Dubai, Apurva support mandates across the Middle East, India and Far East specific to bunkering and shipping related requirements. For inquiries: am@ennero.com – +971 506051905